80000 mortgage over 30 years

Also his home was appraised at 1300000 for the reverse mortgage 2 years ago. A mortgage consultant from Point Mortgage Corporation can help you determine if that is the right mortgage option for you.

Pin On Infographics

RBC says about 360 billion in balance will renew over the next five years.

. See how your payments change over time for your 30-year fixed loan. 31 of BMOs residential mortgage portfolio is insured down from 34 a year ago and 40 in Q3 2020. This means that if you refinance your mortgage to a 15-year term you must spread your deductions over 15 years of tax returns.

But just 1075 million have had a booster equal to 482 of the vaccinated population and just 206 million of the people 50 years old and over who are eligible for a second booster have had one. 51 Arm Mortgage Rates. Because the lender is being paid back slowly over.

If you take out a 30-year fixed rate mortgage this means. Mortgage applicants must be 18 years or over. The 30-year fixed-rate loan is the most common term in the United States but as the economy has went through more frequent booms busts this century it can make sense to purchase a.

N 30 years x 12. Now lets say we use the mortgage to clear the credit card debt. If your home is worth 200000 and you owe 120000 on your mortgage loan you have 80000 in equity.

Initial rate fixed up to and inc. At Point Mortgage Corporation weve been helping customers afford the home of their dreams for over 20 years and we love what we do. It also imposes required incomes limits.

In recent years fixed-rate mortgages have become widely popular for first-time buyers in the UK. The UK has one of the biggest mortgage markets in the UK with 111 million mortgages worth around 13 trillionHome-ownership is more popular in the UK than in many countries across Europe. Although it has declined among younger age groups in recent years buying a home in the UK and getting a mortgage remains something that many.

Owners planning to move. This card features a 1824 2624 variable APR based on creditworthiness. Of those 289 billion are uninsured balances.

71 Arm Mortgage Rates. Todays national 15-year mortgage rate trends. Mortgages are subject to eligibility status and financial standing.

That is subject to a mortgage held by the seller. 60 of the portfolio has an effective remaining amortization of 25 years or less down from 79 a year ago. You may be qualified.

The three possible situations AFTER. Homes larger remodeled with better views larger lots and within 5 blocks of his home sell for around 1400000 to 1600000. If a client has a goal of paying off their home in less than 30 years a 20-year fixed is a good.

You know you want to take out 20000 of your equity with a cash-out refinance but you dont know what you want to spend it on. Let us Point YOU home today. The loan-to-value on the uninsured portfolio is 46 down from 48 a year ago.

90 day delinquencies remain at a near-30-year-low. RBC says its mortgage retention ratio is about 90. If youve been at your current job for over two years theyll be more willing to work with you because it shows you have a steady income.

So thats a total cost of 80000 in interest. If you reside in London your annual household income must be 90000. 30-Year Mortgage Rates.

But his home is small dated on a small lot no view and these seem to sell for 1000000. You might for instance want to refinance a HELOC with an adjustable interest rate one that changes over. Both selections have a marked effect on the interest rate you are offered.

The card offers 3x ThankYou Points per 1 spent at supermarkets gas stations restaurants air travel and hotelsBeyond that the card awards 1x ThankYou Points per dollar spent on all other eligible purchases. The 30-year fixed rate mortgage is the most common type of home loan but there are additional mortgage options that may be more beneficial depending on your situation. Lets take a look.

You can then take out a second mortgage loan a home equity loan against that equity borrowing say 60000. A 20-year fixed-rate mortgage is a loan that amortizes over 20 years at a fixed interest rate. They like to see steady employment for over two years at one job.

However theyd need to put a hold on making. Mortgages in the UK. Condos make up 117 of balances in the banks outstanding residential lending portfolio up from 11 a year ago.

Individuals can put up to 80000 into a 529 plan over a five-year period while still having that money excluded from the gift tax. To qualify your annual household income must be 80000 or less outside of London. Access to this and all other statistics on 80000 topics from.

Most prospective borrowers choose either a 15-year mortgage or a 30-year mortgage. For today Friday September 09 2022 the national average 15-year fixed mortgage APR is 5350 up compared to last weeks of 5290. 301124 Then the Societys BTL Variable Rate less 100 discount up to and inc.

Lets say that you have a mortgage with an 80000 principal. For example if you require a lower interest rate adjustable-rate mortgages ARM offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts. But this was about 300000 too high.

Mortgages Belgium rate fixation 1 to 5 years. The borrower offers to purchase the home for 80000 with a 25000 down paymentjust over 30 of the purchase price. 15 vs 30 yr.

The number of years the loan is scheduled to be paid over. Delinquent 30 days or more as percentage of mortgage loans serviced in survey. After all a mortgage is effectively just a loan but over a much longer period typically 25 years while cards and loans are usually repaid much more quickly and this has a big impact.

Married couples filing jointly can do the same for up to 160000. After five years of on. Earn 80000 a year or less.

Pin By Lunyta Rodgers Ishman On Budget Budgeting Rule Of Thumb Mortgage

Detroit And Toledo Shore Line Railroad Co 1903 Specimen Bond Michigan Ohio 1000 Specimen 4 1st Mortgage Railroad Companies Michigan Ohio Collectibles

7 Effective Tips To Pay Off Your Mortgage Save 80 000 Saving Money Mortgage Payoff Mortgage Tips

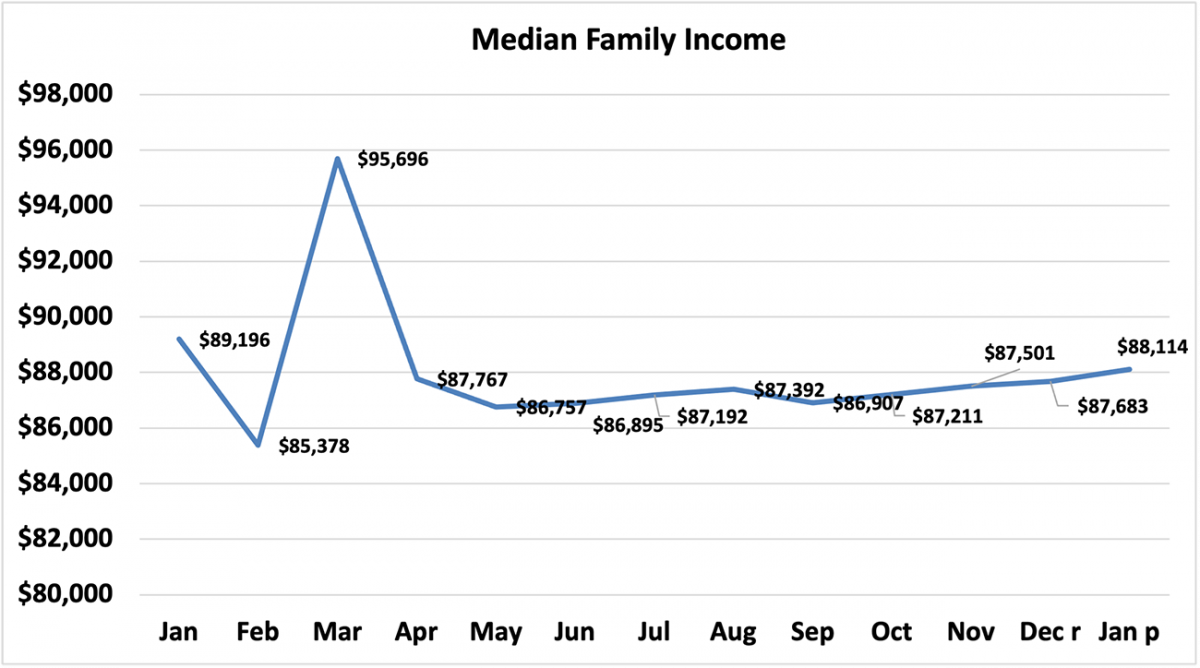

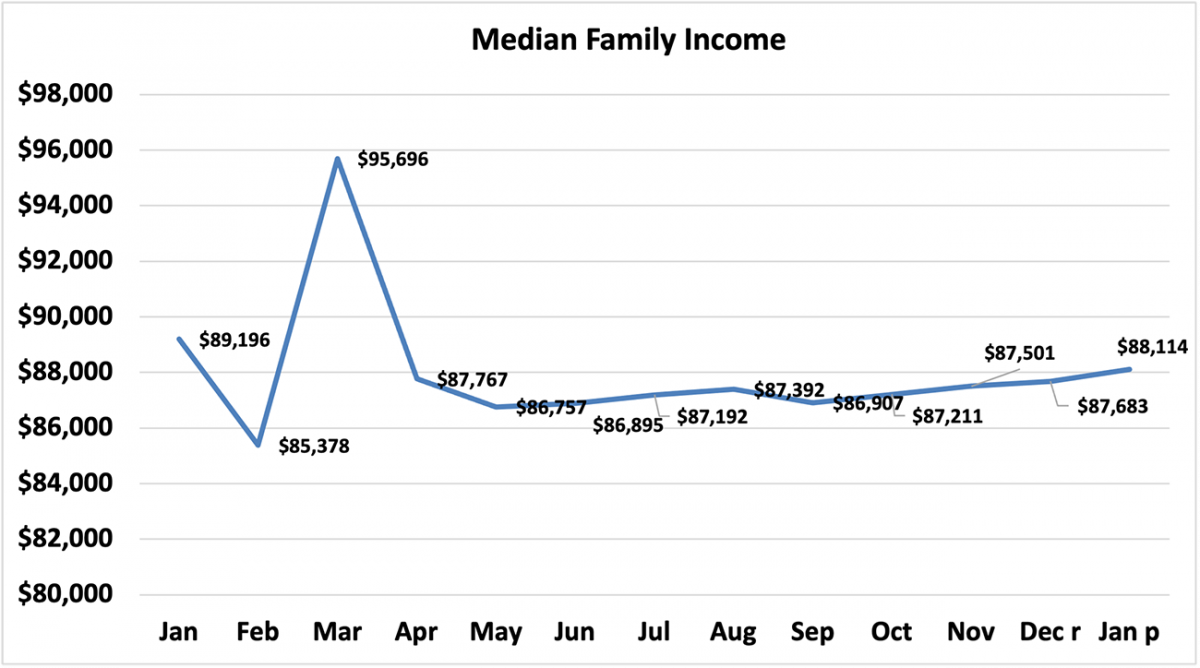

Housing Affordability Conditions Wane In January 2022

What Bad Returns At The Wrong Time Can Mean For College Morningstar Investing For Retirement Wrong Time College Costs

Functional Fitness Vs Bodybuilding A Volume Based Analysis Tier Three Tactical Bodybuilding Strength Program Bodybuilding Program

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

The Rise And Fall Of Bank Loan Funds Morningstar

How We Paid Off 80 000 In 20 Months Debt Payoff Paying Off Student Loans Debt Free

U S Mortgage Delinquency Rate 2000 2022 Statista

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

7 Genius Ways To Payoff Your Mortgage Debt Save 80 000 Mortgage Debt Saving Money Mortgage

Across The County Rent Can Be Just As High As A Mortgage Payment Www Patrickmovesflorida Com Home Buying First Time Home Buyers Retirement Fund

80 000 Mortgages May Face Bigger Bills Rbc Canadian Mortgage Professional

How Healthy Is The Tallahassee Housing Market Charts And Graphs Tallahassee Housing Market

I Make 80 000 A Year How Much House Can I Afford Bundle

An Example The Requested Document The Borrowers Lettering Certified Public Accountant